Interested in Home Additions? Learn About 203(k) Home Improvement Loans

When financing is a main concern to achieve your dream home, a 203(k) home improvement loan could be an excellent option.

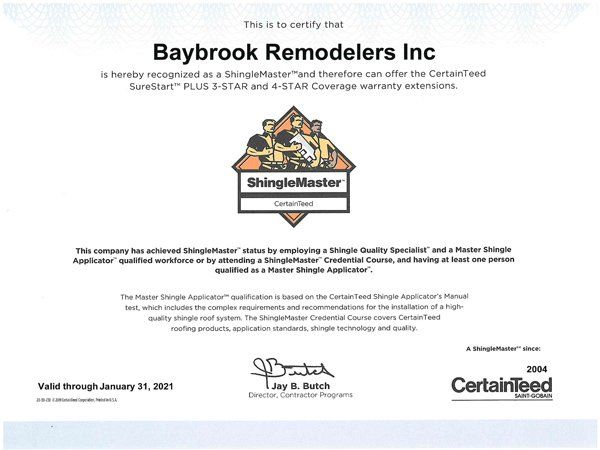

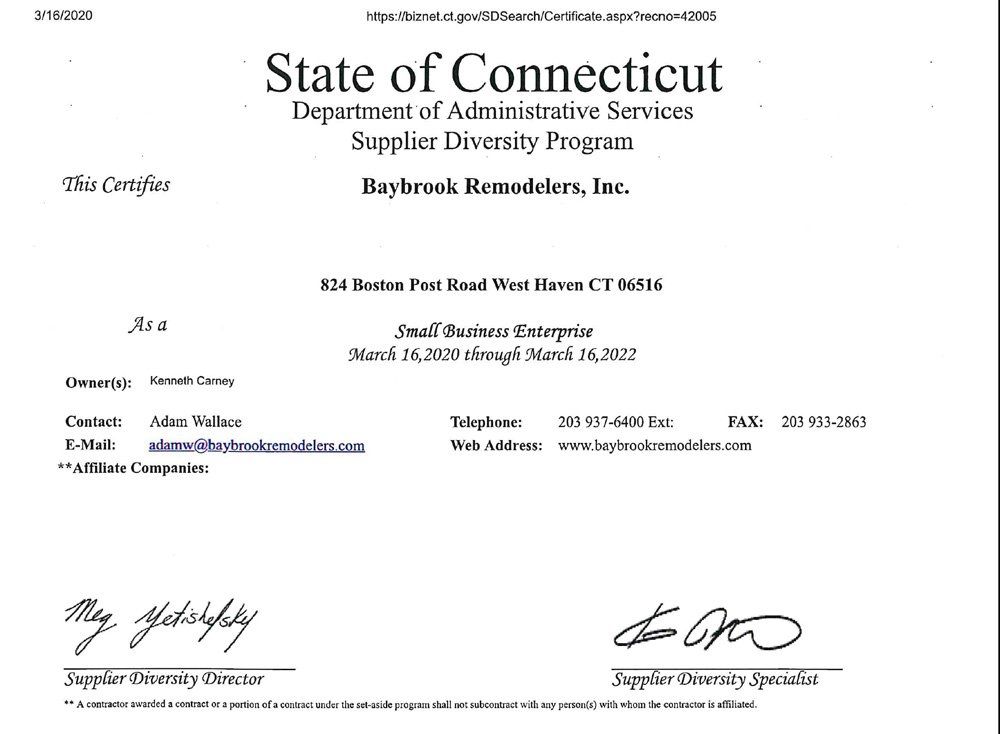

Home additions and remodeling are always an exciting undertaking for new or potential homeowners. When financing is a main concern to achieve your dream home, a 203(k) home improvement loan could be an excellent option. Baybrook Remodelers, located in the heart of West Haven, CT, specializes in helping homeowners who have decided on this loan program. As professional homebuilders who understand the responsibilities of this type of loan, clients often turn to them for advice.

203(k) Home Improvement Loan FAQ for Home Additions

What Is a 203(k) Home Improvement Loan?

A 203(k) home improvement loan is a loan that rolls both a mortgage and home remodeling budget into one. Whether you’re considering buying a fixer-upper or looking to refinance your existing home, this is a great opportunity to fund your home remodeling project in tandem with your mortgage.

Is This Loan Right for You?

What Does It Mean for Your Contractor?

When you secure a 203(k) loan, there are a few rules that must be followed. Most importantly, work on your home remodeling project must begin within 30 days of closing on your loan. Choose homebuilders who understand your timeline and can get started based on these important dates. The entire home addition project will need to be completed within six months, so get a solid commitment from your contractor in writing!

If you live in the greater West Haven, CT, area and are looking for the region’s best homebuilders, call Baybrook Remodelers today at (203) 937-6400 to schedule a consultation. For more information on how an improvement loan can help set your home addition and remodeling plans into motion, download our guide today!